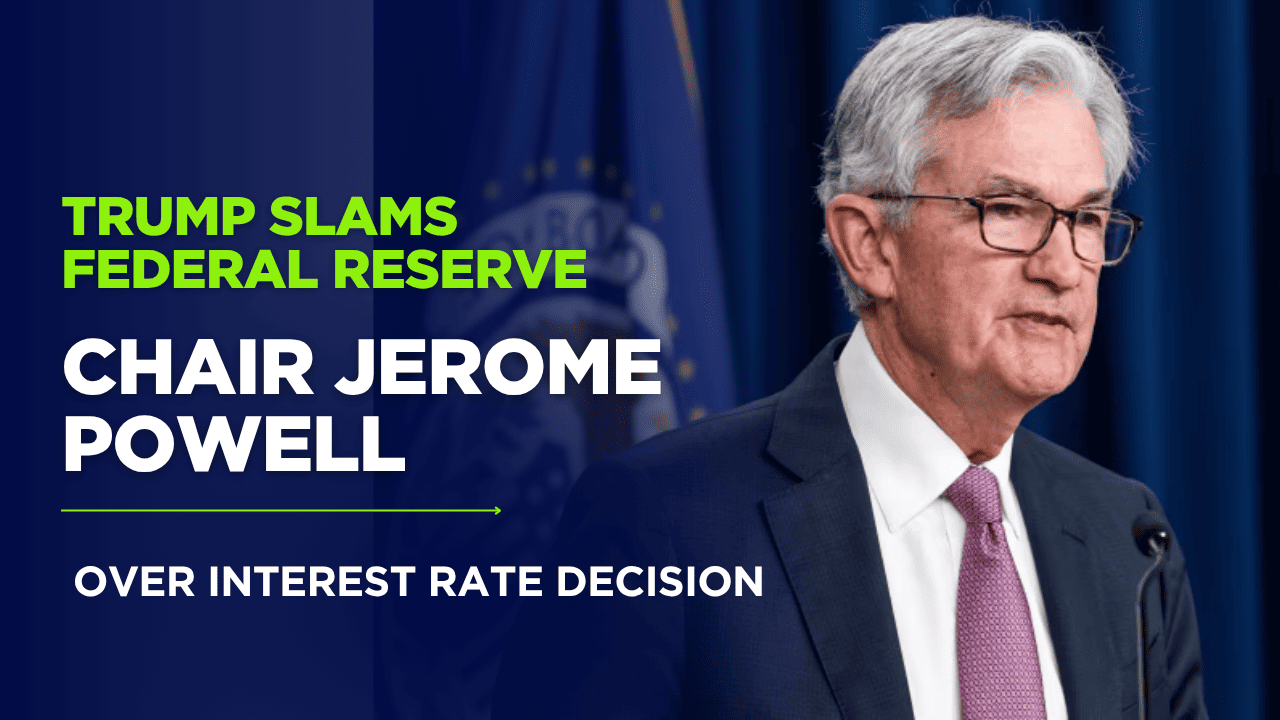

President Donald Trump unleashed a fresh wave of criticism against Federal Reserve Chair Jerome Powell following the central bank’s decision to maintain interest rates for the fourth consecutive time. The Federal Open Market Committee announced on Wednesday that it would keep the borrowing rate steady within a range of 4.25% to 4.5%, a level unchanged since December.

Key Points

- Trump’s Criticism: President Trump labeled Powell a “real dummy” and “destructive” in posts on Truth Social, accusing him of costing the U.S. economy “hundreds of billions of dollars” by not lowering interest rates.

- Rate Decision: The Federal Reserve opted to maintain its current interest rate range of 4.25%-4.5%, with Powell stating the economy’s trajectory requires further observation before policy changes.

- Trump’s Proposal: Trump suggested the U.S. could save billions by cutting rates by 2.5 points, particularly on short-term debt accumulated during the Biden administration.

- Powell’s Term: Powell’s tenure as Federal Reserve Chair is set to end in May 2026, with Trump hinting at an imminent announcement regarding his successor.

- Ongoing Feud: Trump has consistently criticized Powell for resisting calls to lower rates, even suggesting he could lead the Federal Reserve himself for better outcomes.

Trump’s Ongoing Feud with Powell

In a late-night Truth Social post on Wednesday, Trump called Powell a “real dummy,” escalating his criticism by Thursday, branding the Fed chair’s policies as “destructive.” He argued that Powell’s refusal to cut rates is harming the U.S. economy, particularly when compared to Europe, which Trump claimed has implemented 10 rate cuts. “We should be 2.5 points lower, and save $BILLIONS on all of Biden’s Short Term Debt,” Trump wrote, emphasizing the financial burden of high interest rates.

Hours before the Fed’s announcement, Trump preemptively criticized Powell, calling him a “stupid person” and questioning his decision-making. “I guess he’s a political guy, I don’t know. He’s a political guy who’s not a smart person, but he’s costing the country a fortune,” Trump remarked outside the White House.

Federal Reserve’s Stance

Jerome Powell, whose term as chair extends until May 2026, defended the Fed’s cautious approach. “For the time being, we are well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policies,” Powell stated on Wednesday. The decision to hold rates steady reflects the Fed’s focus on monitoring economic indicators amidst inflationary pressures and global uncertainties.

Trump’s Vision for the Federal Reserve

Trump’s frustration with Powell is not new, as he has repeatedly called for lower interest rates to stimulate economic growth. In a bold statement, Trump even floated the idea of taking the Federal Reserve’s helm himself, claiming, “I’d do a much better job than these people.” He also signaled his intent to announce a replacement for Powell “very soon,” raising speculation about the future direction of U.S. monetary policy.

Economic Implications

The Federal Reserve’s decision to maintain interest rates comes amid debates over balancing inflation control and economic growth. Trump’s push for rate cuts aligns with his broader economic agenda, but Powell’s independence as Fed Chair has consistently clashed with the president’s demands. As the 2026 deadline for Powell’s term approaches, Trump’s choice for the next chair could significantly shape the Fed’s policies.

Disclaimer: The information in this article is based on publicly available sources and reflects statements made by President Donald Trump on Truth Social and in public remarks. The views expressed are those of the individuals quoted and do not necessarily reflect the opinions of this publication.

Source: This article is compiled from President Trump’s Truth Social posts and public statements made on June 18-19, 2025, as well as official announcements from the Federal Open Market Committee.

Stay tuned for updates on Trump’s nominee for Federal Reserve Chair and the ongoing debate over U.S. interest rates.