Introduction to the ICT Algorithm

The financial markets are not a chaotic arena of random buying and selling. Instead, they are governed by a sophisticated, automated system known as the algorithm. This electronic, computer-based program is responsible for price delivery across various markets, including Forex, stocks, and commodities. Without this algorithm, price movements would lack direction, drifting aimlessly. The algorithm operates in a loop, seeking liquidity to ensure efficient price action, a concept central to ICT strategies.

What is the Algorithm?

The algorithm is the backbone of modern financial markets, designed to deliver prices in a structured, predictable manner. Here’s what you need to know:

- Automated Price Delivery: The algorithm is a computer program that dictates how prices move in the market, ensuring they follow a predefined path rather than reacting to random buyer or seller pressure.

- Liquidity-Driven: Its primary function is to move from one liquidity pool to another, targeting areas where orders (stop-losses, pending orders) are clustered.

- No Human Control: Contrary to popular belief, the algorithm is not directly controlled by any single institution. It operates autonomously, following its programming to maintain market efficiency.

The truth is, the global financial system cannot afford to rely on unpredictable human trading. Automating price movements through an algorithm ensures reliability and consistency, a fact often overlooked by retail traders.

Who Controls the Algorithm?

While the algorithm itself is an automated system, its design and implementation are influenced by market makers—large institutions and liquidity providers who shape the market’s structure. The algorithm has two primary targets when seeking liquidity:

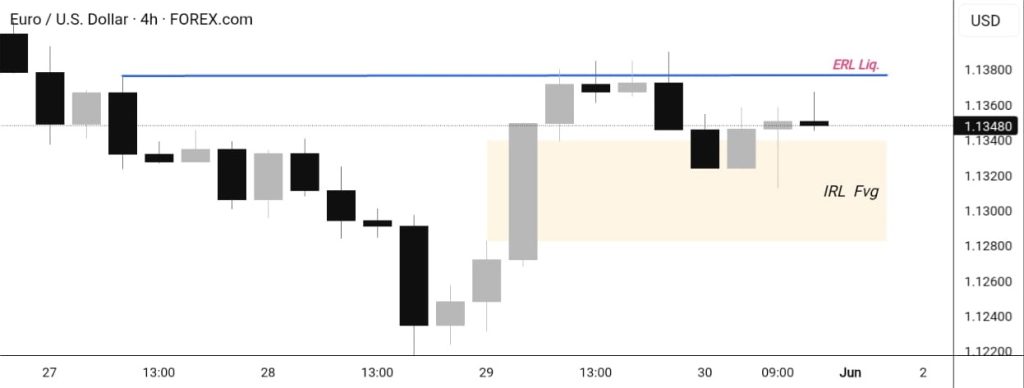

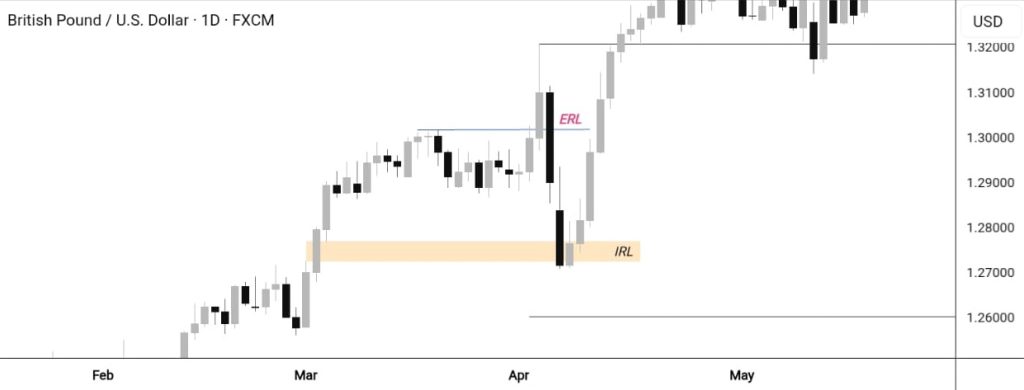

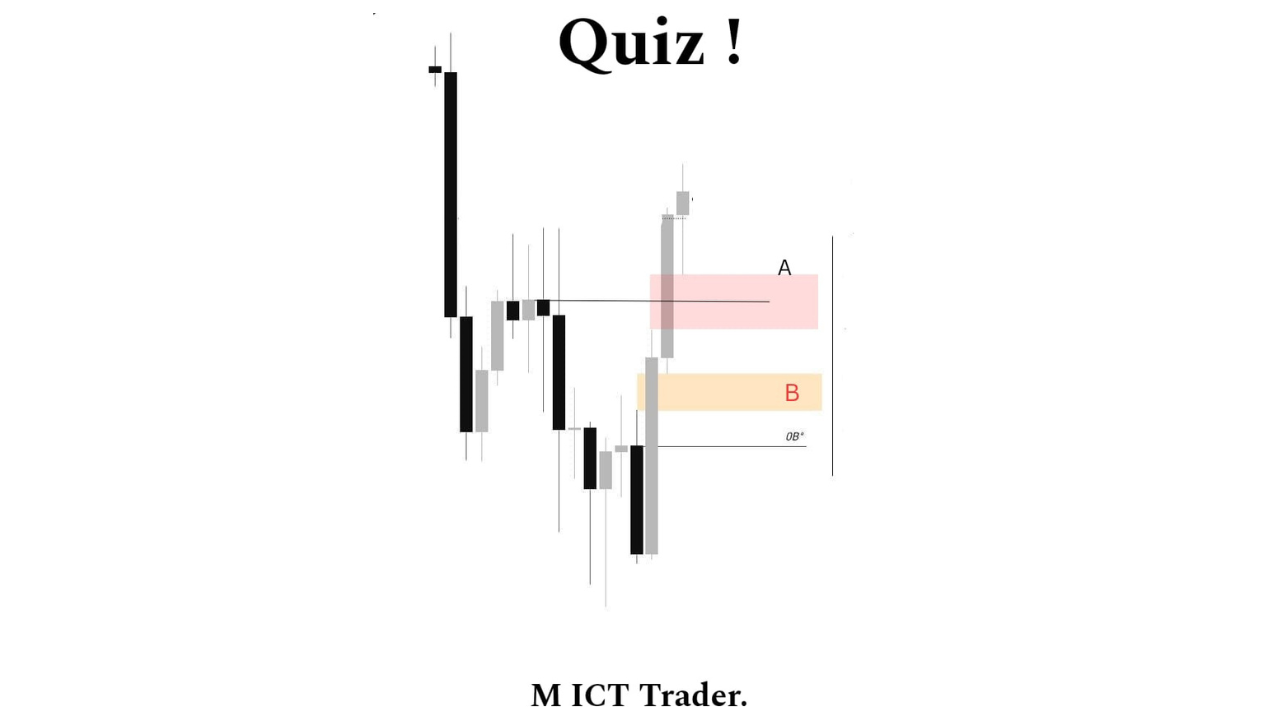

- Liquidity Above/Below Old Highs and Lows: The algorithm hunts for stop-loss orders and pending trades placed by retail traders around significant price levels, such as previous swing highs and lows. This is often referred to as External Range Liquidity (ERL) in ICT terminology.

- Areas of Inefficient Price Action: The algorithm targets price imbalances, such as Fair Value Gaps (FVGs), where price has moved rapidly without fully trading a range, seeking to rebalance these inefficiencies (Internal Range Liquidity, or IRL).

By understanding these targets, Forex traders can anticipate where the algorithm is likely to drive price next, aligning their trades with smart money movements.

What is the Algorithm Based On?

The algorithm’s functionality is rooted in liquidity and market efficiency, operating on the following principles:

- Liquidity Loops: The algorithm is programmed to seek liquidity pools, ensuring that price moves toward areas where orders are concentrated. This creates a cycle of liquidity hunting, driving price from one significant level to another.

- Market Maker Manipulation: Market makers use the algorithm to manipulate price, targeting retail traders’ stop-losses and pending orders to create liquidity for their own positions.

- Efficiency Over Randomness: The algorithm ensures that price movements are efficient, filling gaps and imbalances rather than moving randomly, debunking myths about supply and demand driving the market.

For Forex traders, this means traditional retail concepts like buyer-seller pressure are largely irrelevant. Instead, focusing on liquidity and price imbalances, as taught in ICT strategies, provides a clearer path to profitability.

Advanced Forex Trading with the ICT Algorithm

Understanding the algorithm unlocks advanced trading opportunities for Forex traders on Mr ICT Trader. Here’s how you can apply this knowledge in 2025:

- Identify Liquidity Zones: Use ICT concepts like the MMXM model to mark ERL (old highs/lows) and IRL (FVGs) on your charts. For example, if GBP/USD sweeps an old high at 1.2700, expect the algorithm to target a bearish FVG at 1.2670 next.

- Trade with Market Makers: Align your trades with the algorithm’s liquidity-seeking behavior. If NZD/USD (recently impacted by the RBNZ’s OCR cut to 3.25% on May 28, 2025) breaks a daily low, look for a bullish FVG for a long entry.

- Manage Volatility: Events like Jerome Powell’s upcoming speech at 06:10 AM IST on May 29, 2025, can amplify the algorithm’s movements. Use tight stop-losses (e.g., 20 pips) and risk 1% per trade to navigate volatility.

Debunking Retail Trading Myths

The ICT algorithm perspective challenges common retail trading myths:

- Myth 1: Supply and Demand Drive Price: Price isn’t moved by buyer-seller pressure but by the algorithm’s liquidity-seeking loop.

- Myth 2: Markets Are Random: Without the algorithm, price movements might be random, but its programming ensures structured delivery.

- Myth 3: Retail Strategies Work Consistently: Traditional retail concepts fail because they ignore market maker manipulation, which the algorithm facilitates.

By focusing on the algorithm, traders can move beyond these misconceptions and trade with a clearer understanding of market dynamics.

Conclusion: Mastering the Market with ICT

The ICT algorithm, as presented by Musadiq ICT, reveals the true nature of price movements in the Forex market. It’s not about random buying or selling—it’s about a computer-driven system seeking liquidity and efficiency, controlled by the unseen hands of market makers. For Forex traders in 2025, understanding this algorithm is the key to aligning with smart money and achieving consistent results.

At Mr ICT Trader, we encourage you to apply these insights using ICT strategies like the MMXM model. Whether you’re trading GBP/USD during the UK Summer Bank Holiday or NZD/USD after the RBNZ’s recent OCR cut, the algorithm’s principles will guide your decisions. Stay tuned for more chapters to deepen your ICT knowledge and elevate your trading journey.

Disclaimer: Forex trading involves significant risks. Always conduct thorough research and consult a financial advisor before trading.

2 thoughts on “Mastering the ICT Trading Algorithm: Unlock Market Makers’ Secrets in Forex Trading”

This has been very educative information , looking forward for more of such lessons thanks a lot.

Thank you so much. Looking forward to seeing your videos on this topics.