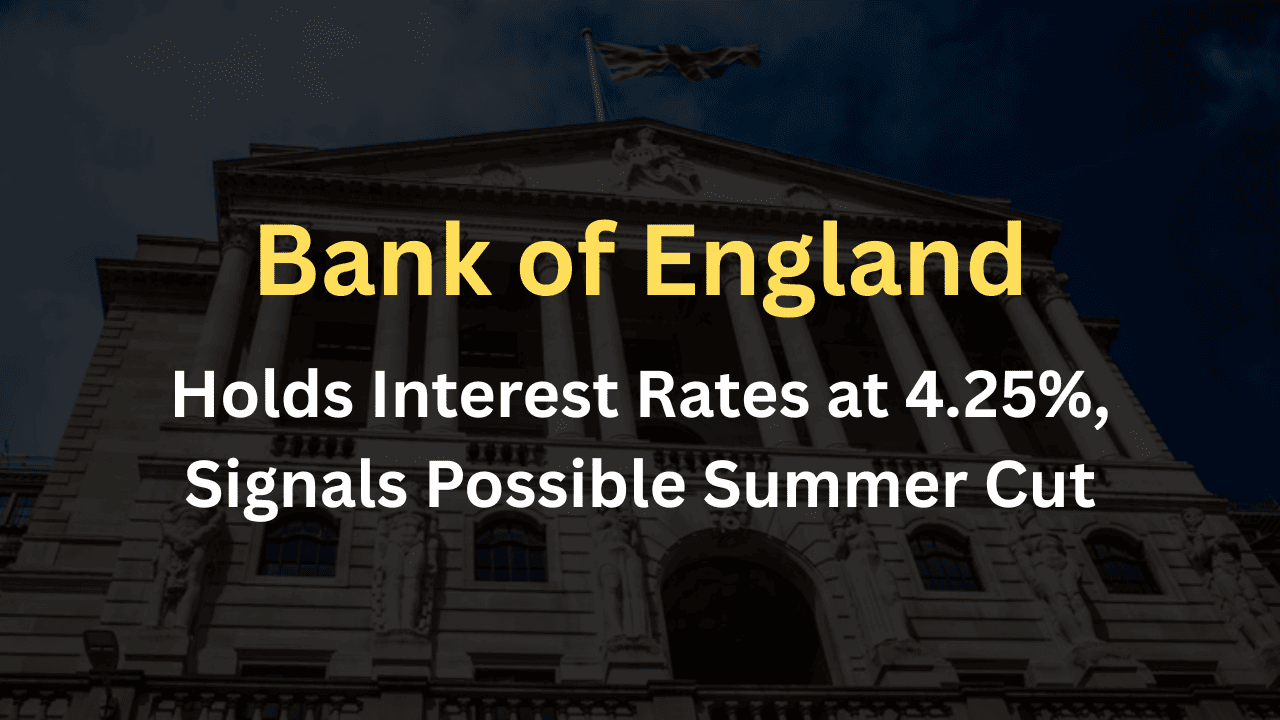

Key Points: Bank of England Interest Rate Decision (June 19, 2025)

- BoE holds interest rates steady at 4.25%, as expected.

- MPC votes 6-3; three members favor a 0.25% cut.

- Inflation at 3.4% in May, projected to hit 3.7% in Q3 2025.

- Rising oil prices and U.S. trade policy uncertainties fuel caution.

- Markets see 85% chance of a rate cut to 4% in August.

- UK economy contracted 0.3% in April; job market slowing.

- Homeowners and renters await relief as mortgage costs remain high.

On June 19, 2025, the Bank of England (BoE) kept its key interest rate at 4.25%, aligning with market expectations amid persistent inflation and global uncertainties. The Monetary Policy Committee (MPC) voted 6-3, with three members pushing for a 0.25% cut to 4%, reflecting cautious optimism about future easing.

Reasons Behind the Hold

Inflation remains sticky at 3.4% in May 2025, with forecasts of a rise to 3.7% in Q3 due to an 8.5% surge in oil prices driven by Middle East tensions. The UK economy shrank by 0.3% in April, and a cooling job market adds pressure, but the BoE remains wary of U.S. trade policies potentially stoking inflation. Governor Andrew Bailey stressed a “gradual” approach, leaving the door open for cuts without committing to August.

Summer Rate Cut on the Horizon?

Markets are pricing in an 85% chance of a 0.25% cut to 4% in August, with two cuts expected by year-end, lowering rates to 3.75%. A softening labor market and sluggish growth could tip the scales toward easing, provided inflation doesn’t spike further.

Impact on Households and Businesses

High borrowing costs continue to squeeze households, with 1.6 million mortgages due to roll off fixed rates in 2025. While some lenders like Santander have cut mortgage rates, widespread relief hinges on BoE action. Renters face rising costs as landlords pass on expenses. Savers, however, benefit from steady returns for now.

Looking Ahead

The BoE’s August meeting will be pivotal, with analysts expecting a cut if economic weakness persists. The BoE’s cautious stance mirrors the U.S. Federal Reserve’s approach, which also held rates at 4.25%-4.50%.

Stay tuned for updates on the BoE’s next moves as it balances inflation and growth.

Sources: Reuters, BBC News, The Independent